VANCOUVER, BC, May 3, 2022 – Banyan Gold Corp. (the "Company" or "Banyan") (TSXV: BYN) (OTCQB: BYAGF) is pleased to announce the last of the analytical results from the diamond drill holes completed during the Company’s 2021 exploration program at the Powerline deposit (the “Powerline Deposit”) located on the Company’s AurMac Property.

Assay highlights include:

- 15.5 metres (“m”) of 1.31 g/t Au from 186.9 m in DDH AX-21-181

- 34.5 m of 1.29 g/t Au from 133.1 m in DDH AX-21-186

- 53.3 m of 0.76 g/t Au from 61.0 m in DDH AX-21-188

- 36.5 m of 0.56 g/t Au from 169.2 m in DDH AX-21-188

- 15.5 m of 2.18 g/t Au from 35.0 m in DDH AX-21-189

- 38.2 m of 0.60 g/t Au from 76.1 m in DDH AX-21-190

- 50.3 m of 0.46 g/t Au from 50.3 m in DDH AX-21-192

- 100.8 m of 0.37 g/t Au from 47.0 m in DDH AX-21-196

- 21.2 m of 3.02 g/t Au from surface (4.6m) in DDH AX-21-198

- 48.9 m of 0.53 g/t Au from 62.4m in DDH AX-21-203

“The 2021 drill program has demonstrated the extensive nature of gold mineralization around the Powerline Deposit on the AurMac Property and importantly, defined zones of higher grade near surface gold mineralization.” Tara Christie, President & CEO of Banyan stated. “The 2021 results have guided the initial drill program in 2022 allowing us to take large step outs to showcase the regional potential of the mineralization on the AurMac Property. We are also pleased that the purchase of Alexco’s underlying interest in the McQuesten option agreement by Victoria Gold, has allowed Banyan to secure amendments providing additional flexibility in timing for the Preliminary Economic Assessment (“PEA”) and removes the hard deadline for the Pre-Feasibility Study. This provides us the optionality to design the optimal project plan for our economic studies as we continue to grow our resource base."

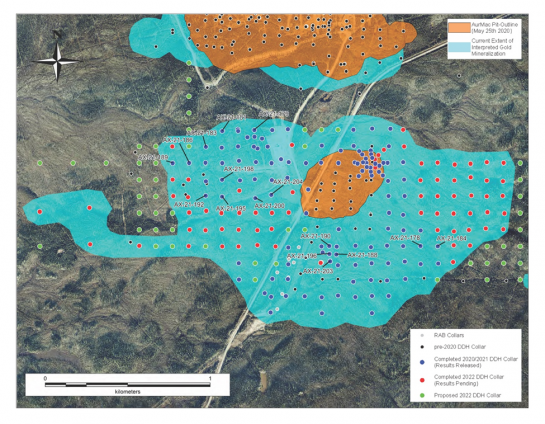

Results from the final sixteen (16) 2021 drill holes are consistent with previous exploration drill results at the Powerline Deposit (see Tables 1 and 2 and Figure 1) and the areal extent of interpreted gold mineralization from near/on-surface continues to expand with each batch of assay results received (see Figure 1).

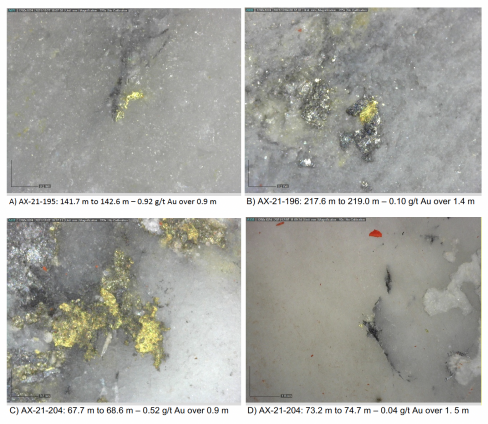

Visible gold from these holes is shown in Image 1. A video to accompany this news release and additional information is located on our website.

Image 1: Photographs of visible gold from:

A) AX-21-195: 141.7 m to 142.6 m – 0.92 g/t Au over 0.9 m

B) AX-21-196: 217.6 m to 219.0 m – 0.10 g/t Au over 1.4 m

C) AX-21-204: 67.7 m to 68.6 m – 0.52 g/t Au over 0.9 m

D) AX-21-204: 73.2 m to 74.7 m – 0.04 g/t Au over 1. 5 m

Figure 1: Powerline Drill Hole Locations and Drill Plan Map, showing historic, completed, and proposed diamond drill holes.

Table 1: 2021 Highlighted Powerline Diamond Drill Analytical Results. (Maps, sections and full assay results will be available on Banyan’s website).

|

Hole ID |

From (m) |

To (m) |

Interval (m*) |

Au (g/t) |

|

AX-21-178 |

9.1 (surface) |

24.4 |

15.3 |

0.58 |

|

and |

41.2 |

50.3 |

9.1 |

0.38 |

|

and |

187.9 |

195.1 |

7.2 |

0.91 |

|

and |

238.0 |

248.4 |

10.4 |

0.52 |

|

|

|

|

|

|

|

AX-21-179 |

109.4 |

118.0 |

8.6 |

0.61 |

|

|

|

|

|

|

|

AX-21-181 |

186.9 |

202.4 |

15.5 |

1.31 |

|

|

|

|

|

|

|

AX-21-183 |

48.8 |

96.4 |

47.6 |

0.28 |

|

and |

125.5 |

151.0 |

25.5 |

0.38 |

|

and |

179.8 |

224.0 |

44.2 |

0.29 |

|

|

|

|

|

|

|

AX-21-184 |

32.0 |

35.0 |

3.0 |

0.36 |

|

and |

102.1 |

134.9 |

32.8 |

0.25 |

|

|

|

|

|

|

|

AX-21-186 |

33.9 |

41.0 |

7.1 |

0.76 |

|

and |

133.1 |

167.6 |

34.5 |

1.29 |

|

and |

222.2 |

227.2 |

5.0 |

1.08 |

|

|

|

|

|

|

|

AX-21-188 |

61.0 |

114.3 |

53.3 |

0.76 |

|

and |

169.2 |

205.7 |

36.5 |

0.56 |

|

|

|

|

|

|

|

AX-21-189 |

35.0 |

50.5 |

15.5 |

2.18 |

|

and |

181.4 |

199.6 |

18.2 |

0.55 |

|

|

|

|

|

|

|

AX-21-190 |

76.1 |

114.3 |

38.2 |

0.60 |

|

and |

121.0 |

144.1 |

23.1 |

0.33 |

|

and |

163.0 |

183.5 |

20.5 |

0.68 |

|

and |

202.6 |

220.6 |

18.0 |

0.43 |

|

|

|

|

|

|

|

AX-21-192 |

39.6 |

89.9 |

50.3 |

0.46 |

|

and |

125.0 |

131.1 |

6.1 |

0.83 |

|

and |

150.3 |

187.6 |

37.3 |

0.47 |

|

|

|

|

|

|

|

AX-21-195 |

39.5 |

73.2 |

33.7 |

0.48 |

|

and |

126.3 |

142.6 |

16.3 |

0.50 |

|

and |

190.7 |

200.6 |

9.9 |

0.52 |

|

|

|

|

|

|

|

AX-21-196 |

47.0 |

147.8 |

100.8 |

0.37 |

|

and |

199.6 |

207.3 |

7.7 |

0.70 |

|

|

|

|

|

|

|

AX-21-198 |

4.6 (surface) |

25.8 |

21.2 |

3.02 |

|

and |

126.5 |

138.7 |

12.2 |

0.65 |

|

and |

160.1 |

190.5 |

30.4 |

0.41 |

|

|

|

|

|

|

|

AX-21-200 |

70.1 |

111.3 |

41.2 |

0.42 |

|

and |

145.6 |

154.7 |

9.1 |

0.46 |

|

|

|

|

|

|

|

AX-21-203 |

62.4 |

111.3 |

48.9 |

0.53 |

|

|

|

|

|

|

|

AX-21-204 |

54.9 |

83.8 |

28.9 |

0.54 |

*True widths are estimated to be approximately 90% of drilled intervals.

Table 2: Drill Collar Location for Released Results

|

Collar ID |

East NAD83_Z8 |

North NAD83_Z8 |

Elev. (m) |

Azimuth |

Dip (°) |

Depth (m) |

|

AX-21-178 |

467798 |

7082602 |

821 |

359 |

-74 |

263.65 |

|

AX-21-179 |

466795 |

7083298 |

779 |

359 |

-61 |

207.26 |

|

AX-21-181 |

466601 |

7083292 |

758 |

001 |

-64 |

219.46 |

|

AX-21-183 |

466502 |

7083197 |

746 |

355 |

-61 |

224.03 |

|

AX-21-184 |

467902 |

7082600 |

826 |

359 |

-60 |

240.79 |

|

AX-21-186 |

466401 |

7083100 |

746 |

357 |

-61 |

237.74 |

|

AX-21-188 |

467290 |

7082551 |

807 |

003 |

-59 |

220.98 |

|

AX-21-189 |

466301 |

7083099 |

736 |

358 |

-58 |

201.17 |

|

AX-21-190 |

467247 |

7082602 |

803 |

002 |

-59 |

237.74 |

|

AX-21-192 |

466501 |

7082904 |

759 |

002 |

-57 |

210.31 |

|

AX-21-195 |

466600 |

7082898 |

765 |

351 |

-60 |

242.32 |

|

AX-21-196 |

467248 |

7082554 |

803 |

356 |

-58 |

235.13 |

|

AX-21-198 |

466600 |

7083000 |

763 |

000 |

-59 |

288.04 |

|

AX-21-200 |

466801 |

7082889 |

769 |

003 |

-56 |

210.31 |

|

AX-21-203 |

467252 |

7082511 |

804 |

356 |

-58 |

201.17 |

|

AX-21-204 |

466897 |

7082909 |

773 |

359 |

-60 |

89.95 |

Amendments to McQuesten Property Option

The Aurmac Property is comprised of the Aurex and McQuesten properties, as well as claims staked and owned 100% by Banyan Gold. Banyan currently holds 51% of the underlying Aurex and McQuesten Properties with original agreements where Banyan can earn 100% of each property, subject to an NSR, from Victoria Gold Corp. and Alexco Resource Corporation, respectively (See Company news release, May 25, 2017).

On April 26, 2022 Victoria Gold Corp. (Victoria) purchased the underlying interest on the McQuesten property from Alexco Resource Corporation (Alexco) which will entitle Victoria to receive payments from Banyan of $600,000 in cash or shares by December 2023 and $2 Million cash or shares by December 2025 as well as acquire the underlying NSR royalty interest from the original agreement with Alexco. The original option agreement was modified to remove the requirement for a Pre-Feasibility Study by 2025 and move the requirement for the PEA from 2023 to 2025 (earn in to 100%). The standstill with Victoria Gold at 19.9% remains and all other substantive terms of the option agreement remain unchanged.

Upcoming Events

Banyan will be attending:

- Vancouver Resource Investment Conference (Cambridge House) – May 17 & 18, 2022

- Booth and Presentation 1:30 pm PDT, May 17

- PDAC 2022 – Toronto, Ont., June 13-15, 2022

- Invest Yukon Conference, Dawson City, Yukon, June 21-23, 2022

All events are subject to change.

2022 Exploration Program Update

Banyan started its 2022 exploration program on January 26, 2022 and has three drills operating on the property. Seventy-one (71) drill holes and over 15,700 metres (“m”) of drilling has been completed to expand the mineralization around the Powerline Zone by 600 m to the east and 1,000 m west. The 2022 program will include 80% of the drilling focused on expansion of the mineralization at Powerline and connecting Aurex Hill; and 20 % focused on testing high priority regional targets on the AurMac Property and Nitra Property.

Analytical Method and Quality Assurance/Quality Control Measures

All drill core splits reported in this news release were analysed by Bureau Veritas Minerals of Vancouver, B.C. utilizing the aqua regia digestion ICP-MS 36-element AQ200 analytical package with FA450 50-gram Fire Assay with AAS finish for gold on all samples. All core samples were split on-site at Banyan’s core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the Bureau Veritas, Whitehorse preparatory laboratory where samples are prepared and then shipped to Bureau Veritas’s Analytical laboratory in Vancouver, B.C. for pulverization and final chemical analysis. A robust system of standards, ¼ core duplicates and blanks was implemented in the 2021 exploration drilling program and was monitored as chemical assay data became available.

COVID-19 Update

Banyan continues to take proactive measures to protect the health and safety of our Yukon communities, our contractors and our employees from COVID 19. Exploration activities will continue to have additional safety measures in place, regularly updated to follow and exceed all the recommendations of Yukon’s Chief Medical Officer.

About Banyan

Banyan's primary asset, the AurMac Property is comprised of the Aurex and McQuesten properties, as well as claims staked and owned 100% by Banyan Gold, and adjacent to Victoria Gold's Eagle Gold Mine, in Canada’s Yukon Territory. The initial resource for the AurMac Property of 903,945 oz Au (see Table 3 below) was announced in May 2020. Our major strategic shareholders include Franklin Gold and Precious Metals Fund, Osisko Development, and Victoria Gold Corporation. Banyan is focused on gold exploration projects that have the geological potential, size of land package and proximity to infrastructure that is advantageous for a mineral project to have potential to become a mine. Our Yukon based projects both fit this model and our objective is to gain shareholder value by advancing projects in our pipeline.

The 173 sq km AurMac Property lies 30 km from Victoria Gold's Eagle Project and adjacent to the Keno Hill Silver District operated by Alexco Resource Corp. and is highly prospective for structurally controlled, intrusion related gold-silver mineralization. The property is located adjacent to the main Yukon highway and just off the main access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Property benefits from a 3-phase powerline, existing Yukon Energy Corp. switching power station and cell phone coverage. Banyan optioned the properties from Victoria Gold and Alexco, respectively, with a right to earn up to a 100% interest, subject to royalties.

The Initial Mineral Resource Estimate for the AurMac Property was prepared in 2020 and consisted of 903,945 ounces of gold (see Table 3). It is a near surface, road accessible pit constrained Mineral Resource contained in two near/on-surface deposits: the Airstrip deposit and the Powerline Deposit.

Table 3: Pit-Constrained Inferred Mineral Resources at a 0.2 g/t Au Cut-Off – AurMac Property

|

Deposit |

Classification |

Tonnage |

Average Au Grade |

Au Content |

|

Airstrip |

Inferred |

45,997,911 |

0.524 |

774,926 |

|

Powerline |

Inferred |

6,578,609 |

0.610 |

129,019 |

|

Total Combined |

Inferred |

52,576,520 |

0.535 |

903,945 |

Notes:

- The effective date for the Mineral Resource is May 25, 2020.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,500/ounce, US$1.50/t mining cost, US$2.00/t processing cost, US$2.50/t G+A, 80% heap leach recoveries, and 45° pit slope.

- The Mineral Resource Estimate was prepared in accordance with National Instrument NI 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) requirements by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc, with technical report filed on SEDAR on July 7,2020.

The Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt is a sediment hosted, structurally controlled, intrusion related gold deposit, with a large land package (over 125 sq km), with the resource contained in the Main Zone area (900 m x 600 m) daylighting at surface and numerous other known surface gold targets. It appears the Main Zone oxide zone would be amenable to heap leach open pit mining, with column leach recoveries of 86%. The project has an existing gravel access road.

Table 4 shows the Hyland Main Zone Indicated Gold Resource Estimate, prepared in accordance with NI 43-101, at a 0.3 g/t gold equivalent cutoff, contains 8.6 million tonnes grading 0.85 g/t AuEq for 236,000 AuEq ounces with an Inferred Mineral Resource of 10.8 million tonnes grading 0.83 g/t AuEq for 288,000 AuEq ounces.

Table 4: Hyland Main Zone Indicated Gold Resource Estimate

|

Cut-off Grade (AuEq g/t) |

In situ Tonnes |

Au |

Ag |

AuEq |

|||

|

Grade (g/t) |

Ozs |

Grade (g/t) |

Ozs |

Grade (g/t) |

Ozs |

||

|

Indicated |

|||||||

|

0.3 |

8,637,000 |

0.78 |

216,000 |

7.04 |

1,954,000 |

0.85 |

236,000 |

|

Inferred |

|||||||

|

0.3 |

10,784,000 |

0.77 |

266,000 |

5.32 |

1,845,000 |

0.83 |

288,000 |

Notes:

- Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimate.

- Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq. AuEq grade is based on $1,350.00/oz Au, $17.00/oz Ag and assumes a 100% recovery. The AuEq calculation does not apply any adjustment factors for difference in metallurgical recoveries of gold and silver. This information can only be derived from definitive metallurgical testing which has yet to be completed.

- Mineral Resource Estimate prepared in accordance with NI 43-101 by Robert Carne, Allan Armitage and Paul Gray dated and filed on SEDAR on May 1, 2018.

Banyan trades on the TSX-Venture Exchange under the symbol “BYN” and is quoted on the OTCQB Venture Market under the symbol “BYAGF”. For more information, please visit the corporate website at www.BanyanGold.com or contact the Company.

Qualified Person

Paul D. Gray, P.Geo., Vice President of Exploration for the Company, is a “qualified person” as defined under National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”), and has reviewed and approved the content of this news release. Mr. Gray has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the information

ON BEHALF OF BANYAN GOLD CORPORATION

(signed) "Tara Christie"

Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 • tchristie@banyangold.com

Jasmine Sangria • 604 312 5610 • jsangria@banyangold.com

CAUTIONARY STATEMENT: Neither the TSX Venture Exchange, its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) nor OTCQB Venture Market accepts responsibility for the adequacy or accuracy of this release.

No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

FORWARD LOOKING INFORMATION: This news release contains forward-looking information, which is not comprised of historical facts. Such information can generally be identified by the use of forwarding-looking wording such as “may”, “will”, “expect”, “estimate”, “anticipate”, “intend”, “believe”, “potential” and “continue” or the negative thereof or similar variations. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s plans for drilling this year; and statements regarding exploration expectations, exploration or development plans; and mineral resource estimates. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, uncertainties inherent in resource estimates, continuity and extent of mineralization, capital and operating costs varying significantly from estimates, the preliminary nature of metallurgical test results, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects and the other risks involved in the mineral exploration and development industry, enhanced risks inherent to conducting business in any jurisdiction, and those risks set out in Banyan’s public documents filed on SEDAR. Although Banyan believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Banyan disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.